Table of contents

Wondering how the China tariffs impact your print-on-demand business? You’re not alone – and you’re in the right place.

In this guide, we’ll explain what tariffs are, how US-China trade relations are developing in 2025, and what it means for Printful sellers. You’ll also get practical strategies to stay ahead of the changes, plus answers to the questions on every seller’s mind.

Key takeaways

-

President Donald Trump’s administration reintroduced higher import duties in 2025, raising the current tariffs on China to 145% before a temporary reduction.

-

A 90-day agreement between Washington and Beijing, starting May 14, 2025, brought both sides back to the negotiating table, temporarily lowering tariffs to 30% for the US and 10% for China. This truce has since been extended into November 2025.

-

China's retaliatory tariffs on US exports reached 125% before being reduced, affecting key American industries, including apparel and electronics.

-

Thanks to our global supply chain and local fulfillment, most Printful products remain unaffected, but some items shipped from China may now be subject to duties.

-

Trade policy may evolve further in 2025, so it’s essential for print-on-demand sellers to stay informed and adaptable.

A 90‑day agreement starting May 14 temporarily lowered many US tariffs on Chinese imports to 30% and many Chinese tariffs on US goods to 10%, offering short‑term relief for sellers. This truce has since been extended into early November 2025, though some high tariffs and sector‑specific measures remain in force.

Disclaimer:

This content is for informational purposes only and does not constitute professional advice. The content is based on our understanding as of the date of publication. Readers are encouraged to seek advice from qualified professionals. Any actions taken based on this information are at your own risk.

What is a tariff, and how do tariffs work?

Let’s start with the basics.

A tariff is a tax imposed on goods imported from other countries. Tariffs can increase the cost of foreign goods, encourage domestic production, and in some cases, generate government revenue or influence trade relationships.

Types of tariffs

There are three common types:

-

Ad valorem tariffs: These are percentage-based. For example, a 20% tariff on a $100 product adds $20.

-

Specific tariffs: A fixed fee per unit, like $5 per imported t-shirt, regardless of price.

-

Retaliatory or reciprocal tariffs: These are introduced in response to tariffs from another country, often to counter trade actions or apply pressure in trade negotiations.

Tariffs are paid by the importer when goods enter the country, but that cost is often passed down to consumers through higher prices. For print-on-demand (POD) sellers, tariffs can influence everything from blank product costs to delivery times – more on that below.

US and tariffs on China: An overview

Tariffs between the US and China aren’t new. However, in the first quarter of 2025, they reached new levels following tariff increases introduced under the current US trade policy.

A quick timeline of 2025 China tariffs

-

February 1: A 10% tariff was imposed on all Chinese imports, and the de minimis exemption (which had allowed duty-free treatment of imports under $800) was removed for Chinese goods.

-

March 4: Tariffs rose to 20% on Chinese items, while the de minimis exemption was temporarily reinstated until US Customs updated enforcement systems.

-

April 8–10: Tariffs reached a combined 145%, due to the addition of a 125% reciprocal tariff layered on top of the existing 20% IEEPA tariff.

-

China's response to Trump tariffs followed quickly – on April 8, Beijing imposed an 84% retaliatory tariff on select US goods, which was then increased to 125% on April 11. China’s tariffs on US exports targeted key industries including textiles, electronics, and agricultural products.

-

May 2: The de minimis exemption was permanently removed for Chinese and Hong Kong goods, meaning low-value orders are no longer duty-free.

-

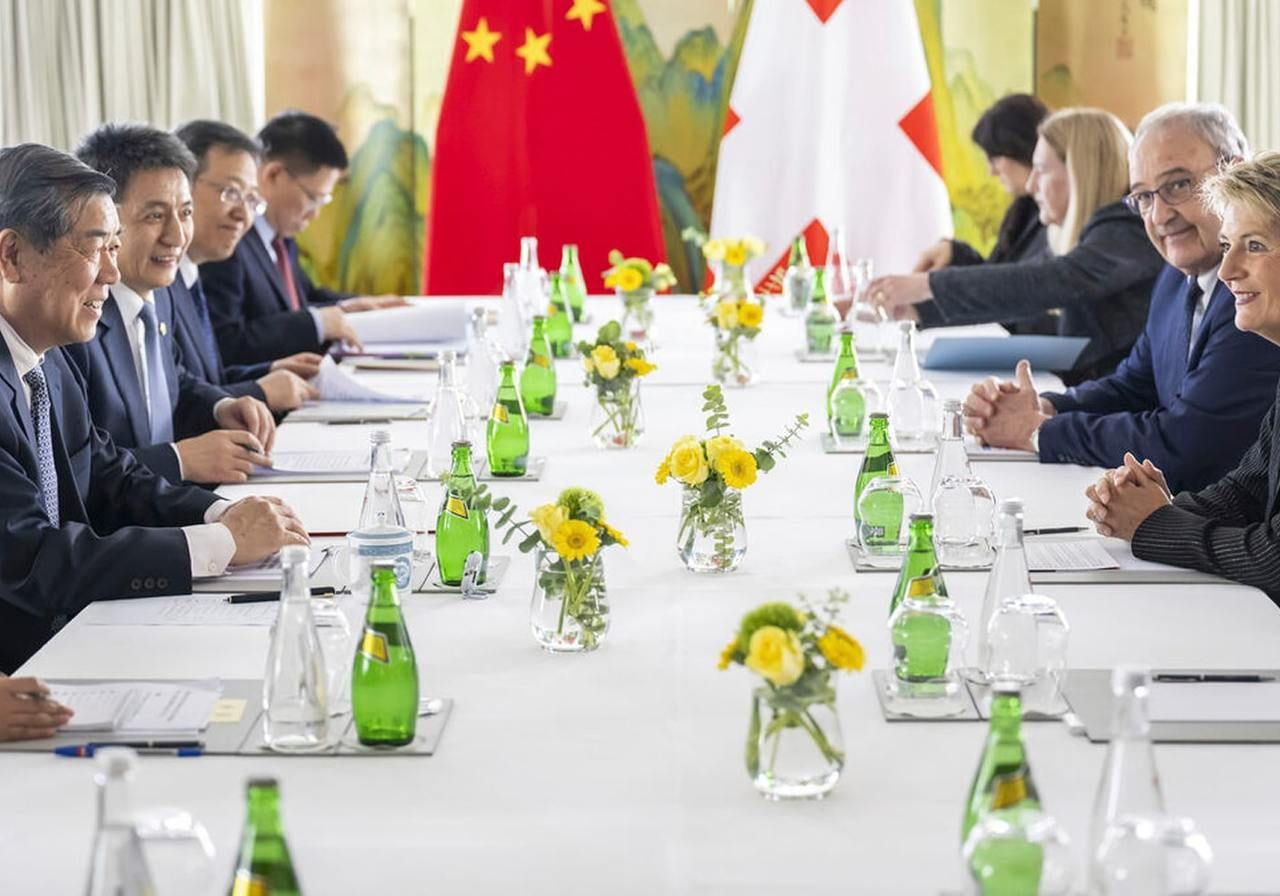

May 14: Following trade talks in Switzerland, the US and China agreed to a 90-day tariff reduction, temporarily lowering US tariffs to 30% and Chinese tariffs to 10%. This truce has since been extended into early November 2025, though some high tariffs and sector-specific measures remain in force. Both Washington and Beijing considered the move a step toward mutual benefit.

US and China trade talks in Switzerland, May 2025. Source: The Irish Examiner

While this temporary agreement brings short-term relief, negotiations remain ongoing, and further changes are expected later this year. The US central bank keeps monitoring the ripple effects of trade disruptions, especially as tariff-related costs influence inflation and lending conditions.

What categories are most affected?

The tariffs imposed on Chinese goods affect a broad range of imports, including:

-

Apparel and textiles

-

Footwear

-

Electronics

-

Plastic goods

-

Accessories and custom packaging

-

Certain raw materials, agricultural products, and components

For print-on-demand sellers in America, many blank products (like windbreakers, shoes, pet items, and more) are manufactured in China, so tariff changes can directly affect sourcing costs and fulfillment logistics.

China tariffs 2025: How do they affect Print on Demand?

Now, let’s focus on what this means for your print-on-demand business.

While not every product is affected, some sourcing and fulfillment workflows may need extra attention, especially if you sell apparel or accessories manufactured in China.

1. Increased product costs and changes in fulfillment dynamics

If you use blank products sourced from China, tariffs may increase your base costs, especially for high-impact categories like clothing, footwear, and accessories. Even if your items are printed locally, tariffs can still apply if the blanks come from China.

Printful’s strength lies in its ability to fulfill locally in multiple regions, including the US, Mexico, Canada, and Europe. That flexibility means most Printful orders are not subject to cross-border tariffs, but product origins still matter.

Tip: Stay informed about President Trump’s tariffs on Canada and Mexico and how they affect your business and global markets on our blog.

2. End-customer charges on specific items

With the end of the de minimis exemption, some Chinese-fulfilled items are now subject to import duties upon delivery. This includes the following products shipped from China and Hong Kong to the US:

-

All-over print windbreakers

-

Track pants

-

Custom shoes

-

Pet collars, leashes, and bowls

-

Knitted sweaters and cardigans

-

Slim-fit polo shirts

-

Crossbody bags

If you sell these items, your US customers may need to pay duties on delivery. These charges aren’t included in Printful’s fulfillment price.

We recommend adding a simple disclaimer to your listings to avoid surprises. For example:

“Please note: Additional import duties may apply for US orders if your item ships from overseas. These charges are not included in the item price and are the customer’s responsibility.”

3. Shipping and logistics

Printful’s logistics teams are actively managing operations. No shipping delays are currently expected, but customs processes may evolve based on ongoing trade talks. Our team is monitoring developments closely.

Strategies for POD sellers

Here are a few ways to stay ahead of China tariffs:

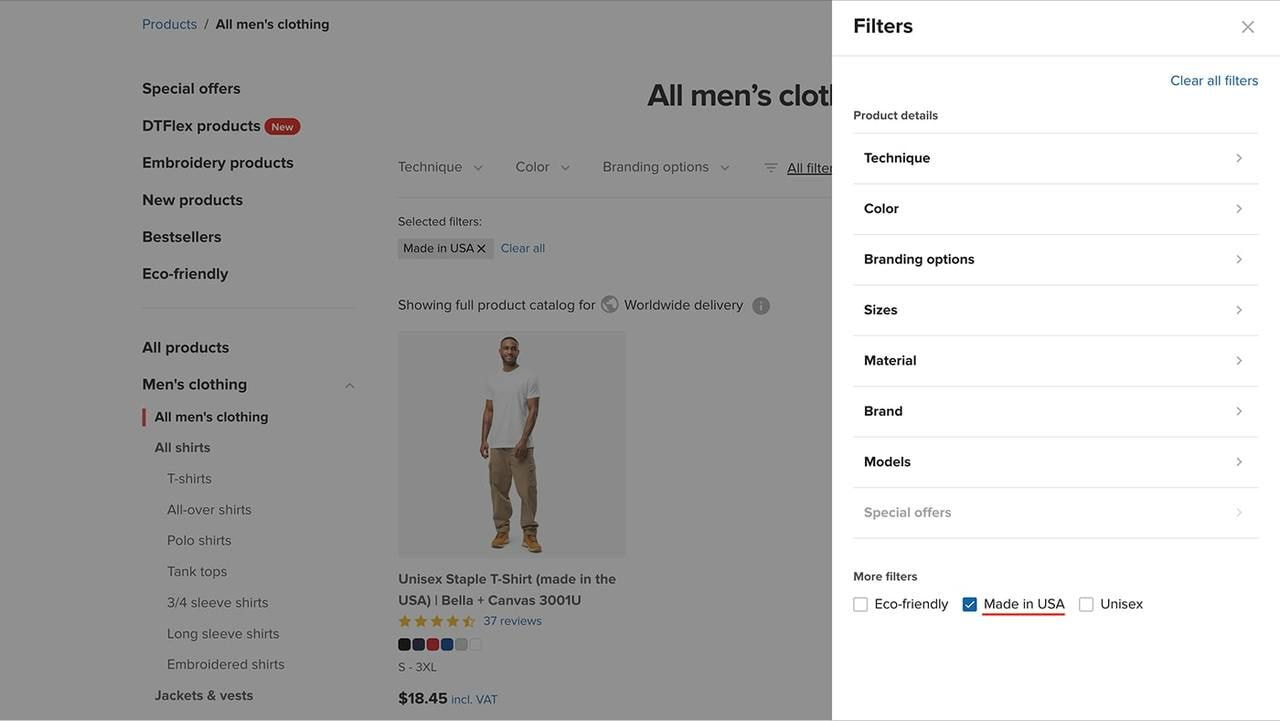

Stick with local fulfillment and unaffected items

Products made and fulfilled in the same country aren’t subject to import tariffs. Most items in Printful’s Catalog are fulfilled in the US for US-based customers, helping you avoid extra costs. Use the filters to select products labeled Made in the USA.

Use clear communication

Be transparent with your customers if you’re selling items that may incur extra fees. Add a short disclaimer to the product description and offer support if questions arise.

Monitor pricing (but don’t panic)

Printful isn’t raising prices due to tariffs at the moment, and we’re absorbing costs where possible. We'll provide notice well in advance if changes are necessary, whether due to tariffs, supply issues, or interest rate shifts.

Stay informed

Keep an eye on trade updates and the White House’s press releases. We’ll do our best to post the latest tariff news related to Printful on our blog and Help Center. Additionally, subscribe to reliable economic news sources to track developments.

FAQ

As of April 2025, the Trump China tariffs reached a total of 145%, combining:

-

20% IEEPA tariff

-

125% reciprocal tariff

After May 14, tariffs were temporarily lowered to 30% for US imports from China and 10% for Chinese imports from the US, following a 90-day agreement reached during trade meetings in Switzerland.

The arrangement has since been extended into early November 2025, though elevated rates and category-specific restrictions continue to apply in certain sectors.

It’s unlikely, but as many major reports on trade risk emphasize, a sudden trade halt would cause massive global supply chain disruptions. Prices for many imported goods would rise sharply, and financial markets and companies around the world – including POD sellers – would face limited alternatives in the short term. The Federal Reserve would likely intervene to stabilize economic conditions in the event of a sudden trade halt.

That’s why Printful builds flexibility into its supply chain – sourcing globally, fulfilling locally – to help minimize disruptions.

If you’re a US-based merchant ordering products shipped directly from China, yes, you may have to pay import duties. However, when you use Printful, we handle the importing process.

In most cases, you won’t see a separate charge, and your customer won’t either – unless the product is from the affected list and fulfilled in China. In those cases, your customer will be responsible for paying duties on delivery.

To conclude

President Trump’s tariff policy has shaped trade discussions, and in 2025, US-China trade relations continue to shift.

For print-on-demand sellers, the impact depends on what products you sell and where they’re fulfilled. Printful’s global network and local production model help sellers manage these changes and stay resilient in a shifting economy.

We’re not raising prices due to tariffs at this time. Behind the scenes, our teams are working hard to absorb costs, minimize delays, and protect your profitability.

The coming weeks and months may bring new trade deals or revised terms that further reshape the pricing landscape for sellers across multiple nations. As always, stay informed, keep your listings up to date, and don’t hesitate to contact our support team if you have questions.

Published author, scholar, and musician, Andris draws on over 11 years of experience in and outside academia to make complex topics accessible – from SEO and website building to AI and monetizing art. Devoted to his family and self-confessed introvert, he loves creating things, playing musical instruments, and walking around forests.